Understanding Income Tax on Unlisted Shares In India

In the words of Benjamin Franklin, there are only two things that are certain in life; death and taxes. If you earn money by means of wages, company or even renting a home, you need to pay income tax. So, what about the money you earn by investing in unlisted shares? Do you need to pay income tax on that as well?

Short answer: yes.

But, determining how much income tax you need to pay on unlisted shares is not easy. It is crucial for you to be informed of them in order to make informed financial decisions.

In this post, we shall understand how income tax is imposed on unlisted shares in India. But, before delivering into the tax on unlisted shares, let’s first understand what are unlisted shares.

What Are Unlisted Shares?

Unlisted shares are a financial instrument that is not listed on a formal market as it does not conform with the listing criteria. Unlisted shares are traded on the over-the-counter (OTC) market and are sometimes referred to as OTC securities. Retail investors or brokers promote the acquisition and sale of unlisted shares on the OTC market.

The most popular example of unlisted security is common shares, mostly exchanged on the NASDAQ. However, securities trading at the highest floor of the NASDAQ broker network structure, the National Business System, are usually not listed as OTC since NASDAQ is deemed to be a stock exchange. That being said, stock trading on the lower strata, like the OTC Bulletin Board (OTCBB) or even the pink sheets, falls under the OTC classification umbrella.

There are also several unlisted non-stock securities, like mutual funds, government securities, and some derivative products, like swaps, which are exchanged on the OTC exchange.

Capital Gain on Sale of Unlisted Shares

Unlisted shares are typically sold by smaller or emerging companies who are unable or unable to comply with listing conditions, such as market capitalization rates or ability to pay trading fees, on an official exchange basis. Besides that, since they are not exchanged, unlisted shares are also less liquid than listed securities. Unlisted inventory can be monitored via pink sheets or OTCBB (OTC Bulletin Board).

When it comes to determining the short and long term capital gains on unlisted shares, it’s important to note that these shares are not mentioned on any approved stock exchange. The Company does not, therefore, pay STT, i.e. The value of securities exchange tax on those shares. The retention time is 24 months.

- Long Term Capital Gain (LTCG): If an owner sells unlisted shares owned for longer than 24 months, the gain or loss on those transactions is Long Term Capital Gain (LTCG) as well as Long Term Capital Loss (LTCL).

- Short Term Capital Gain (STCG): If an owner sells unlisted shares held for close to 24 months, the short-term capital gains or losses is the short-term capital gain (STCG) and short-term capital loss (STCL).

- Long Term Capital Gain (LTCG): If an owner sells unlisted shares owned for longer than 24 months, the gain or loss on those transactions is Long Term Capital Gain (LTCG) as well as Long Term Capital Loss (LTCL).

- Short Term Capital Gain (STCG): If an owner sells unlisted shares held for close to 24 months, the short-term capital gains or losses is the short-term capital gain (STCG) and short-term capital loss (STCL).

- Long Term Capital Gain (LTCG): If an owner sells unlisted shares owned for longer than 24 months, the gain or loss on those transactions is Long Term Capital Gain (LTCG) as well as Long Term Capital Loss (LTCL).

- Short Term Capital Gain (STCG): If an owner sells unlisted shares held for close to 24 months, the short-term capital gains or losses is the short-term capital gain (STCG) and short-term capital loss (STCL).

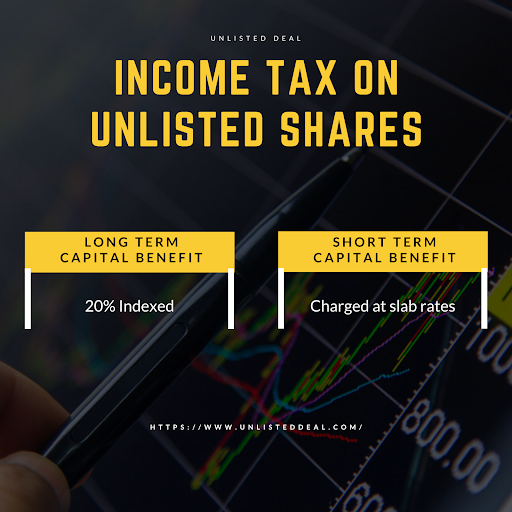

Income Tax on Unlisted Shares

The Income Tax on Unlisted Shares is identical to the tax status on other financial properties. The above are the income tax thresholds for the selling of unlisted shares of the Domestic Company or the International Company.

Long Term Capital Benefit – 20% Indexed

Short Term Capital Benefit – charged at slab rates.

Note: In the case of non-residents, LTCG on non-listed shares is 10% without inflation.

Tax on IPO Shares

The shareholder trades the Unlisted Stock Shares of the Company that offers an IPO (Initial Public Offering) to the public. These shares are then listed on a well-known stock exchange and STT is therefore paid on the very same stock exchange. The tax status applied to the sale of those unlisted shares will be the same as in the case of the shares listed as follows:

- Long Term Capital Gain-taxed under Section 112AA at 10% over INR 1 lac

- Short term capital benefit, levied under Sec 111AA at 15%

- For Unlisted Shares, ITR Form, Due Date and Tax Audit Applicability

- ITR Form: Trader can register ITR 2 (ITR for Capital Gains Revenue) on the Income Tax Website, as income from the selling of unlisted shares is a capital gain.

Due Date

- Up to 2019-20

- 31st July – for merchants who are not subject to a tax audit

- 30 September – for merchants to whom the tax audit applies

- FY 2020-21 Ahead

- 31st July – for merchants who are not subject to a tax audit

- October 31st – for merchants to whom the tax audit relates

Tax Audit

Although the revenue from the selling of unlisted shares is a tax benefit income, it is not appropriate to assess the validity of the tax audit under Section 44AB.

Carry Forward Loss on Sale of Unlisted Shares

The investor will offset Short Term Capital Loss (STCL) against other Short Term Capital Gain (STCG) as well as Long Term Capital Gain (LTCG). They will hold the residual loses for 8 years and head off against STCG and LTCG only.

The creditor can only cover Long Term Capital Loss (LTCL) against Long Term Capital Gain (LTCG). They will carry the residual loss for 8 years and head off against LTCG only.

How To Report Income From The Sale In The Income Tax Return?

You should register ITR-2 and declare profits from the selling of unlisted shares of a domestic or international corporation as capital gains. You can pay income tax on it at the rates below:

- Long Term Capital Benefit – 20% indexation

- Short Term Capital Benefit – Slab Levels

The assessee may set up LTCL with LTCG and STCL for both STCG and LTCG. The residual loss will be carried on for 8 years.

Will the STT be paid for unlisted shares?

STT i.e. Securities Transaction Tax is a tax on the acquisition and selling of securities listed on a registered Indian stock exchange. As a result, STT is not charged on Unlisted Shares. However, while a corporation is selling shares to the public under the IPO, i.e. Initial Public Offering, those shares are listed on the stock market at a later date. In such instances, the STT is paid to the Unlisted Shares.

9137718552

9137718552  harshil@unlisteddeal.com

harshil@unlisteddeal.com