API Holdings Limited (PharmEasy) Unlisted Shares

Company overview:

API Holdings Limited is the largest digital healthcare platform (based on GMV of products and services sold for the year ended March 31, 2021) which through custom-built technology platform and supply chain capabilities, operates an integrated and end-to-end interconnected network business serving the healthcare needs of stakeholders.

The company has received SEBI approval for IPO to raise funds by issuance of shares of the company. The IPO is entirely for fresh funds raise and does not have any portion of shares being sold by existing investors of the company.

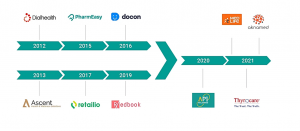

Progress till now:

The founders started Dialhealth, a consumer pharmaceutical delivery service in Mumbai where they realized the supply chain issues. As a result, they founded ascent in 2013 which distributed pharma products to pharmacies where they built strong supply chain capabilities. After building strong supply chain capabilities in 2015, founders built a pharmeasy marketplace. They acquired docon in 2016 which provides EMR and clinic management service along with teleconsultation offerings. The company built retailio to accelerate technology adoption and to expand supply chain capabilities beyond pharmacies. In 2020, all businesses were consolidated into API holdings to create an integrated digital healthcare platform. In 2021, they acquired medlife, aknamed, and thyrocare. They also acquired a 49% stake in Marg.

With these acquisitions, the company now touches every stakeholder involved in healthcare – consumers, doctors, laboratories, and hospitals.

Board of directors of the company:

Past performance of the company:

(All figures INR in crores except EPS data)

The company issued 10 bonus shares for every share held on 28th October 2021 and also sub-divided equity shares from FV 10 to FV 1.

DRHP - API Holdings Limited

Unlisteddeal review:

- The company has a strong product portfolio and huge distribution network, which has benefited the API Holdings Limited (PharmEasy) share price.

- The overall market size is growing which will benefit the company.

- The recent acquisitions have resulted in the company being able to provide end-to-end solutions which are expected to increase the customer base of the company.

API Holdings Limited in the news:

Frequently Asked Questions (FAQs) on API Holdings Limited (PharmEasy) Unlisted Shares:

1. How to buy API Holdings Limited (PharmEasy) Unlisted Shares:

The step-by-step process for buying API Holdings Limited (PharmEasy) at current Share Price in unlisted Market is as follows:

- Step 1:A deal is reached between us and buyer either on WhatsApp or over email.

- Step 2:Buyer transfers deal amount to bank account details provided by us and provide us below documents:

- Remitter name, account number, bank name and UTR no. for the amount transferred to us.

- Client master copy of the remitter. The shares will be transferred to details provided in the client master copy.

- PAN card

- Step 3:We shall transfer shares to buyer account on the same day of receipt of funds and raise contract note for the same.

Diagram showing how to buy shares is as below:

See the Infographic flow to buy the shares

2. How to sell API Holdings Limited (PharmEasy) Unlisted Shares:

Step by step process to sell Unlisted shares of API Holdings Limited (PharmEasy) Unlisted Shares is as under:

- Step 1:A deal is reached between us and seller either on WhatsApp or over email.

- Step 2:Seller transfer shares to unlisteddeal.com’s dp details provided to them and provide their PAN card and beneficiary bank details

- Step 3:We shall remit the funds (make the payment) to the seller on the same day of receipt of shares.

Diagram showing how to sell shares is as below:

See the Infographic flow to sell the shares

9137718552

9137718552  harshil@unlisteddeal.com

harshil@unlisteddeal.com